Digital Wallet Loans: Fast and Secure Borrowing Options

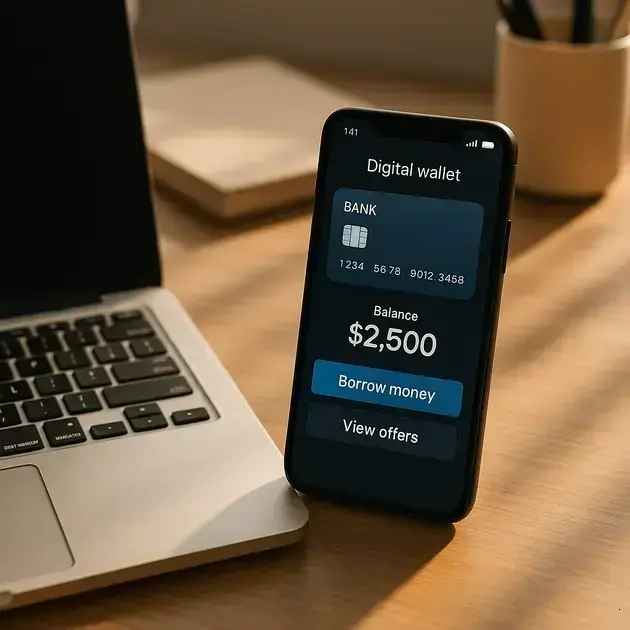

Have you ever wondered how fast borrowing can actually get in today’s digital age? The concept of a digital wallet loan might just change the way you handle urgent financial needs. With the rise of digital finance, borrowing money is becoming more accessible everywhere.

Many people face unexpected costs and don’t have time for lengthy loan processes. Digital wallet loans promise not only speed but also security, reducing the headaches of traditional lending. But how safe and smart are these options?

This article dives into everything you should know about digital wallet loans—their benefits, possible pitfalls, and practical steps to get started. If you’re curious about borrowing fast without sacrificing security, keep reading.

Understanding digital wallet loans basics

Digital wallet loans are a modern type of financial service allowing users to borrow money quickly through digital wallet platforms. These loans are designed to provide fast access to funds with minimal paperwork and typically use your digital wallet activity to assess eligibility.

Unlike traditional loans, digital wallet loans often use alternative credit scoring models based on transaction history, payment behavior, and wallet usage. This innovation offers financial inclusion for users who might not qualify for bank loans.

Key Features of Digital Wallet Loans

- Instant approval: Many digital wallet loan providers use automated systems to approve loans within minutes.

- Minimal documentation: Most applications require only digital identity verification and wallet-linked data.

- Flexible repayment: Borrowers can often choose repayment schedules aligned with their income cycles.

How It Works

The process begins when you link your digital wallet to a loan service, which analyzes your financial activity.

- Sign up with a digital wallet loan provider and connect your digital wallet account.

- The system reviews your transaction data to estimate creditworthiness.

- If approved, you receive an offer detailing loan amount, interest rate, and repayment terms.

- Accept the offer and the funds are transferred directly to your digital wallet.

- Repay the loan according to the agreed schedule using your wallet balance or linked bank account.

Popular Digital Wallet Loan Providers

- PayPal Working Capital by PayPal Holdings, Inc. — Available via the PayPal app and website (paypal.com/workingcapital). Supports Android, iOS, and Web platforms.

Key features: Fast application, no credit check, fixed fee pricing. - Paytm Postpaid by Paytm Payments Bank Limited — Accessible through Paytm app (paytm.com). Android and iOS.

Key features: Buy now, pay later option, EMI plans, instant approval. - GoCredit Wallet Loan by GoCredit Financial Services — Available on their website and app (gocredit.com). Android, iOS.

Key features: Flexible loan amounts, competitive interest rates, easy online application.

Eligibility and Documentation

Typical eligibility requirements include:

- Age: 18 years or older.

- Valid government-issued ID (passport, driver’s license, or national ID).

- Active digital wallet account with history (usually 3+ months).

- Proof of income or regular transactions within your digital wallet.

Documents commonly needed:

- Government-issued ID.

- Proof of address (utility bill or bank statement).

- Bank statement or transaction history from your digital wallet.

Benefits and Risks

Benefits include easy access, speed, and convenience. Borrowers can get funds in minutes with less bureaucracy than traditional loans.

Risks involve higher interest rates compared to banks and the possibility of overborrowing due to ease of access. Always read terms carefully and borrow responsibly.

Benefits and risks of using digital wallet loans

Digital wallet loans offer several benefits that make borrowing fast and convenient for consumers. However, like all financial products, they come with risks that potential borrowers should understand thoroughly before applying.

Key Benefits of Digital Wallet Loans

- Speedy access to funds: Loans are often approved instantly or within minutes through automated systems linked to your digital wallet, eliminating lengthy approval processes typical of traditional banks.

- Convenience: Applications do not require physical visits or extensive paperwork, as most verifications are done digitally through your wallet’s transaction data.

- Inclusive lending: These loans often use alternative data for credit scoring, including transaction history and payment patterns, which can help individuals with limited or no credit history gain access.

- Flexible repayment options: Some providers allow borrowers to choose repayment schedules that align with their cash flow, such as weekly or monthly plans.

- Lower initial costs: Many digital wallet loan services have no application fees or hidden charges.

Risks and Considerations When Using Digital Wallet Loans

- Higher interest rates and fees: Due to the convenience and risk of lending to a wider audience, rates can be higher than traditional loans.

- Data privacy concerns: Sharing detailed digital wallet transaction data with lenders may raise privacy issues; ensure the platform uses strong security and data protection measures.

- Over-borrowing risk: Easy loan access might lead to borrowing beyond your capacity to repay, resulting in debt cycles or financial strain.

- Potential hidden terms: Carefully review loan agreements for penalties, late fees, and conditions that may not be initially obvious.

Best Practices for Safe Use

- Check lender credentials: Verify the loan provider’s registration and legitimacy through official regulatory bodies or consumer protection agencies.

- Read all terms carefully: Understand interest rates, repayment schedules, and any applicable fees.

- Borrow only what you need: Keep loan amounts within your repayment capacity to avoid financial hardship.

- Use official apps and websites: For example, PayPal Working Capital by PayPal Holdings, Inc. (paypal.com/workingcapital) and Paytm Postpaid by Paytm Payments Bank Limited (paytm.com) offer secure platforms with strong user protections.

- Monitor your loan and wallet activity: Regularly check your digital wallet balance and repayment status to avoid missed payments or unauthorized transactions.

How to apply and manage your digital wallet loan

Applying for and managing a digital wallet loan involves several straightforward steps that are designed to provide quick and secure access to funds. Understanding this process can help ensure smooth borrowing and repayment.

Step-by-step application process

- Choose a digital wallet loan provider: Use reputable services like PayPal Working Capital by PayPal Holdings, Inc. (paypal.com/workingcapital), available on Android, iOS, and Web; or Paytm Postpaid by Paytm Payments Bank Limited (paytm.com), available on Android and iOS.

- Create or log into your account: Ensure your digital wallet account is active with verified identification as per the provider’s requirements.

- Complete the loan application: Fill in online forms with personal information and consent to link your digital wallet transaction data for credit evaluation.

- Submit required documents: Typically, a government-issued ID, proof of address, and transaction history from your digital wallet. Requirements may vary by provider.

- Wait for assessment and approval: Automated systems generally review eligibility and respond quickly, often within minutes to hours.

- Review loan offer: Carefully check loan amount, interest rates, fees, and repayment terms before accepting.

- Accept the loan agreement: Sign electronically to finalize and receive funds in your digital wallet.

Managing your digital wallet loan

Effective management ensures you avoid penalties and maintain financial health.

- Track your balance and payments: Use the loan provider’s app or website to monitor your outstanding loan balance.

- Set up automatic payments: Many platforms allow automatic repayment deductions from your wallet or linked bank account to prevent missed payments.

- Understand repayment schedules: Know due dates, amounts, and adjust reminders for timely payments.

- Contact customer support promptly if issues arise: Providers like PayPal and Paytm offer helpline numbers and online chat for assistance.

- Maintain your wallet’s transaction activity: Active wallet use can improve future loan eligibility and terms.

Common documents needed

- Government-issued photo ID (passport, driver’s license, or national identity card).

- Proof of residence (a recent utility bill or bank statement).

- Transaction history from your digital wallet for the past 3-6 months.

Eligibility requirements

- Age 18 or older.

- Valid digital wallet account with consistent usage.

- Good standing account without defaults on previous loans.

FAQ – Frequently Asked Questions About Digital Wallet Loans

What is a digital wallet loan?

A digital wallet loan is a type of loan that allows users to borrow money quickly through their digital wallet account, using their transaction history and wallet activity as part of the credit evaluation.

How do I apply for a digital wallet loan?

You can apply by choosing a reputable digital wallet loan provider, logging into your wallet account, filling an online application, submitting required documents like photo ID and transaction history, and waiting for approval.

What are the common eligibility requirements for digital wallet loans?

Typically, borrowers must be 18 years or older, have an active digital wallet account with a good transaction history, and provide valid identification and proof of residence.

What are the benefits of digital wallet loans?

They offer fast access to funds, convenient application processes without extensive paperwork, flexible repayment schedules, and can help individuals with limited credit history gain borrowing access.

Are there risks associated with digital wallet loans?

Yes, potential risks include higher interest rates compared to traditional loans, data privacy concerns, the risk of borrowing more than one can repay, and possible hidden fees or penalties.

How can I manage my digital wallet loan effectively?

Track your loan balance regularly through the provider’s app, set up automatic payments, understand your repayment schedule, contact customer support when needed, and maintain active wallet usage to improve eligibility for future loans.